Stop buying expensive online course for trading.

I have looked thru all of them and here is my honest feedback.

This article will focus more on Forex Gurus.

The idea is straightforward. If an educator or whoever knows systems or strategy to make money consistently, they should be doing it instead of organizing seminars to teach others how to do it. Their idea of making money for themselves is selling the workshops, not what's sold in the workshops.

Always ask a simple question to yourself, If you know a method to become a millionaire, would you ever reveal your secret?!

They never reveal the fact that 90% of the people who joined their course failed eventually.

Please note that I did not pay for any of this online training course. I got a Russian friend to record and share them with me. For those that are interested in all these gurus, please leave me a message.

Anton Kreil - Decent

Anton is an ex-institutional trader who went on to market himself and his expensive classes on learning to trade forex. One of the rare educators that have a decent track record in the industry professionally. He shares many good contents on youtube. Anyway, he's a pretty cool guy so do google him, it doesn't hurt.

He teaches quality stuff, but if you put enough time into reading books, you can get his teachings from books at a lower price.

Tom Dante - Decent

Tom's a day trader from London, who tells it exactly how it is, he does not attempt to soften the blow from the harsh realities of trading.

He's got a fascinating and unique story about how he got started trading, which was around 1999. And from that point on there was a period of about 7 years, where Tom struggled to gain consistency with his trading results (we speak at lengths about this during the first part of the interview).

After developing a track record of profitability, Tom joined a prop trading firm, where he learnt many of the solid trading principals that have shaped him into the trader he is today – many of which are discussed during this episode.

Nowadays, Tom is an independent trader who focuses mostly on the Bund market intraday, as well as other futures.

Similarly, his teachings are decent and can be learned if you put enough effort to find the right sources.

Adam Khoo - Avoid at all cost

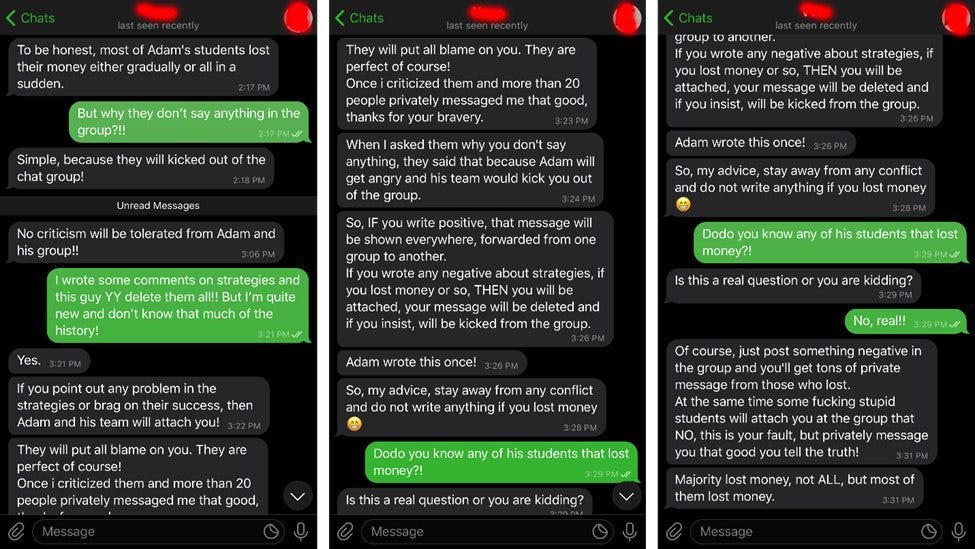

Motivation speaker -> Trader. Just do yourself a favour and google "Adam Khoo Scam", there is even a telegram group dedicated to him.

Conclusion

If you are interested in trading, do not spend too much money on it. Read some books and find your style first. Below is a list of useful books that you can start with to get you up to speed.

Reminiscences of a Stock Operator by Edwin Lefèvre

A classic. This book, first published in 1923, tells a fictionalized account of the life of the securities trader Jesse Livermore. It provides excellent insight into investor psychology - fear and greed - and how trading and speculation shape markets.

Technical Analysis of Stock Trends by Robert Edwards and John Magee

Some people argue that "chart-trading" is futile because prices of stocks, commodities and other financial instruments behave in random fashion. Yet, others point out that, since millions of investors are looking at the same charts, there must be value in studying them. First published in 1948, Technical Analysis of Stock Trends was the first book to describe a methodology for interpreting the behaviour of investors and markets through stock charts: patterns, trendlines, support/resistance areas. It has been revised many times over the years and is a right starting place for investors seeking to learn the fine art of technical analysis.

Random Walk Down Wall Street by Burton Malkiel

Random Walk Down Wall Street popularized the passive approach to investing. In the 1973 book, Burton Malkiel argues that it's impossible to beat the market consistently and therefore it's only better to buy the same stocks as the S&P 500 – or the approach known as index investing. While the success of numerous investors (most notably Warren Buffett), contradict the central premise of the efficient market theory, the book is well-researched and well-written. Moreover, it had a significant impact on the financial world today.

Trading for a Living by Alexander Elder

MACD, Stochastics, RSI? All these indicators, and a lot more, are covered in Trading for a Living. The book is a quick and easy read. It helps to understand the logic and methods used to create many of the indicators available in charting packages today.

The Intelligent Investor by Benjamin Graham

While mostly focused on investing in stocks, the 1949 book the Intelligent Investor by Benjamin Graham is considered the bible of investing. More recent editions include commentary from Jason Zweig, a financial journalist who draws parallels with today's markets and shows readers how to apply Graham's principles in modern-day markets.

Market Wizards by Jack Schwager

Want to hear how the best traders navigate turbulent financial markets? Market Wizards includes interviews with dozens of profitable traders and summarizes what works, and why. The key takeaway: hard work, a sound methodology, and the proper mental attitude are essential ingredients for success.